Frs Which Plan Best for 25yr Old 3 Yr Employee

This website also has resources such as publications and estimate calculators to help you understand your retirement options and ensure that you make the best choice for your future. This pension plan the defined benefit plan has been slated to be done away with by the State of Florida for new.

Early Bird Seminar Nasional Perkembangan Terkini Sains Farmasi Klinis Ke 8 Seminar Nasional Tumbuhan Obat Indonesia Ke 56

The benefit is based on your years of service the 5 highest years of your income and a multiplier.

. FRS Investment Plan 2. DROP is a great plan that was created to incentivize employees to stay a little longer in their most. If you enrolled in the FRS prior to July 1 2011 1 normal retirement is age 62 with at least 6 years of service or 30 years of service regardless of age.

In the FRS Investment Plan your savings grow over time. If you enrolled in the FRS prior to July 1 2011 you need to have 6 years of service with an FRS employer to be vested in your Pension Plan benefit. 25 years Special Risk X 300 X 2500000 1875000 5 years Regular Class X 160 X 2500000 200000 30 years Total Option 1 Annual Benefit Amount 2075000 Divide by 12 to get Monthly Option 1.

The Deferred Retirement Option Program DROP is a plan you can elect after you have reached your vested retirement age or years of service. So lets say that Bob has been working as a federal employee for 31 years and decides to retire when hes 58. You may also view the FRS Pension Plans summary plan description.

If you enrolled in the FRS on or after July 1 2011 you must have 8 years of service to vest. In some circumstances taking an early but reduced retirement. A 414h plan also called a pick-up plan offers people who hold government jobs a tax-advantaged way to grow their savings for retirementIf you work for a local state or federal government agency you may receive one of.

The FRS Investment Plan lets you choose how your money is invested and how you want to receive payments. As required by Section 121712 Florida Statutes employee contributions are treated for tax purposes as employer-paid employee contributions commonly called an employer pick-up. 2 This agency participates in the FRS for its fire employees.

Senior Management employees have a third option the Senior. The Florida Retirement System is a defined benefit pension plan whereby the benefit that you ultimately receive is formula-driven. We value your opinion and your responses will help us pinpoint any areas that need improvement.

FOR FISCAL YEAR 2017-18 Rev 122017 1 This agency participates in the FRS for its police employees. Say you earn 50000 per year and you are a Regular Class member a total of 63 percent of your salary is contributed to the FRS Investment Plan from both employee and employer contributions. If youre a Florida state employee you may be entitled to retirement benefits under the Florida Retirement System FRS.

The FRS Investment Plan Employer Handbook is a technical guide for retirement coordinators payroll staff and others who have FRS responsibilities. FRS retirement benefits are available through regular pension plan disbursements which provide a fixed monthly benefit based on your years of service and salary history and through the FRS investment plan. For example if you enrolled in the FRS on or after July 1 2011 and are a Regular Class member and want to retire early at age 57 with 20 years of service 8 years before age 65 and start receiving your benefit your first year benefit will be reduced 40 8 years x 5 40.

Must complete 100 year of service with a participating FRS employer in a retirement eligible position to qualify for the 600 year vesting provision or. Welcome to the Florida Retirement System. Retire with Special Provisions such as a firefighter LEO air traffic controller and more and be either 50 years old or have 25 years of service.

Retire at age 60 or older with 20 or more years of creditable service. University employees have a third option the State University System Optional Retirement Program SUSORP. FRS Online Services benefit calculator service history etc Division of Retirement DOR Calculations.

The FRS DROP program is a retirement plan that is available to all Florida Retirement Systems employees. Your Retirement Plan Options. FRS DROP Program.

If you reach 1000 years of service before the work year is complete you will be considered vested at. Based on Florida law employees contribute 3 of their pretax salary beginning with their first paycheck regardless of which FRS retirement plan they choose. If you terminated FRS-covered employment before July 1 2001 the vesting period varied.

Overview of the tools available to assist you in choosing a retirement plan. 3 This agency participates in the FRS for its elected officials. 13 X 160 208.

FRS Investment Plan Employer Handbook. Only 50 of 40-year-old FRS employees with 10 years of service stay until normal retirement age 60 of employees stay less than 6 years No benefit if you leave before vesting Investment Plan Requires 1 year of service Pension Plan Requires 6 years of service if hired before July 1 2011. The FRS Pension Plan provides a monthly benefit to you when you retire.

When you work for the state the Florida Retirement System FRS offers two retirement options. Older employees and those employees who do not want to control their retirement plan may also prefer the Pension Plan. Take the Investment Plan Satisfaction Survey.

As a part-time or full-time salaried employee you are a member of the Florida Retirement System FRS and may enroll in either the FRS Pension Plan or the FRS Investment Plan. Active Members Frequently Asked Questions. Interactive video to assist you in choosing a retirement plan.

This handbook is intended to explain the administration of the retirement plan choice process and the FRS Investment Plan in nontechnical language. 208 X 34549 7186 Annual Option 1 Retirement Benefit at Age 62 or 59883 per month An example for Special Risk Class members enrolled in the FRS after July 1 2011. 4 This agency participates in the FRS for its general employees.

As a new employee you must choose between the two available retirement plans before your deadline. Only one plan FRS Pension Plan Employee contributions required. Why the FRS Is Offering This Plan The Pension Plan has been offered to employees for over 50 years.

It is primarily designed to serve longer-service employees who will be with the FRS for most of their career. Visit the FRS Pension Plan website to view details on the FRS Pension Plan. FRS Pension Plan Information.

A 401k is the most common type of employer-sponsored retirement plan but certain employees may have access to a 414h plan instead. Old Plantation Water Control District. If you have 13 years of service and your Average Final Compensation is 34549.

The following resources can help you make your decision. Only 50 of 40-year-old FRS employees with 10 years of service stay until normal retirement age 60 of employees stay less than 6 years No benefit if you leave before vesting Investment Plan Requires 1 year of service Pension Plan Requires 6 years of service if hired before July 1 2011. If you are in the Investment Plan please let us know how satisfied you are with the services provided by the Investment Plan Administrator.

For Special Risk members normal retirement is age 55 with at least 6 years of Special Risk service or 25 years of Special Risk service regardless of age or age 52 with 25 years of Special Risk.

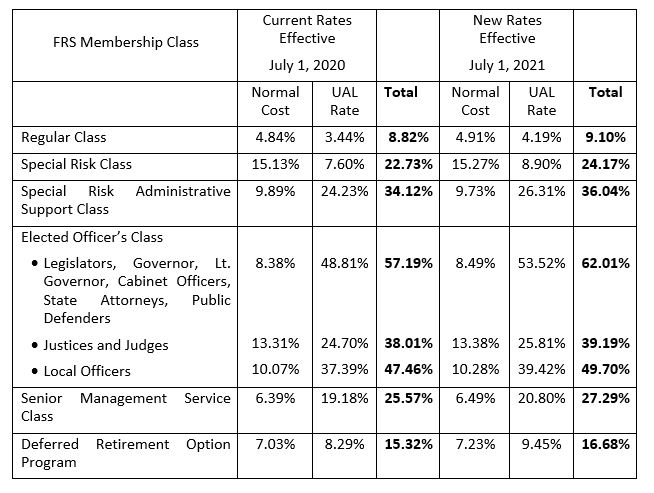

2021 Retirement Legislation End Of Session Report Lewis Longman Walker P A

No comments for "Frs Which Plan Best for 25yr Old 3 Yr Employee"

Post a Comment